Cinovec vertically integrated battery metals project

(49% – EMH / 51% – CEZ)

Largest hard rock lithium project in EU

Cinovec hosts the largest lithium resource in Europe, and one of the largest undeveloped tin resources in the World. The project is located 100 km NW from Prague on the border with Germany, adjacent to a main road with two rail lines within 10km of the deposit. The project is situated in the heart of Europe with ready access to end user car makers and companies involved in energy storage.

Timeline

The Cinovec Project lies in an historic mining region, with artisanal mining dating back to the 1300s.

A large underground mine was established to produce tungsten for the war effort. Mining and processing activities continued under the Czechoslovakian Government with the mine continuing to expand and producing tin as well as tungsten.

Due to the fall of communism and lower tin prices, the mine was closed in 1993. In 2000, the old processing plant was removed and the site rehabilitated.

In 2014, EMH purchased a 100% interest in the exploration rights to the Cinovac Project area together with an extensive database, and commenced drilling campaign to validate the comprehensive data generated by the earlier development and exploration activities. The Company’s ongoing drilling programme has completed 30 diamond holes each averaging 400m depth, successfully validating earlier drilling results, adding lithium grade data and providing metallurgical test work samples.

In 2015, European Metals completed a Scoping Study into the redevelopment of the Cinovec Project. The Scoping Study highlighted that the size, grade and location of the deposit make it a very attractive opportunity and recommended that the project proceed through to a Preliminary Feasibility Study (PFS).

In April 2020 EMH entered a JV with CEZ a.s. to develop Cinovec and expanded the scope of the project to enable Cinovec to becomes Europe’s first vertically integrated battery metal producer. As a result, Cinovec is fully funded to final investment decisions. EMH is currently progressing the Definitive Feasibility Study (DFS) for the construction of a 29,386 tpa lithium hydroxide plant to be located within 9km of the mine.

In October 2021 EMH released an update to the JORC Resource which showed the total resource to be 708Mt at an average grade of 0.42% Li2O for a total of 7.39Mt LCE. This included a Measured Resource of 53.3Mt at 0.48% Li2O (640kt LCE), Indicated Resource of 360.2Mt at 0.44% Li2O (3.88Mt LCE) and a Inferred Resource of approximately 294.7Mt of 0.39% Li2O (2.87Mt LCE). At the current mining rate on the PFS of 2.25Mt per year this would give a mine life of in excess of 100 years.

In January 2022 EMH released an update to the 2019 PFS which showed the vastly improved economics of the Cinovec Project as set out below.

Excellent 2022 Pre-Feasibility Study (PFS) Update Results

The 19 January 2022 PFS Update indicates that Cinovec has the potential to be the lowest cost hard rock lithium producer in the World.

PFS Key Findings

29,386tpa battery grade LiOH.H2O

Annual production

7.39 Mt LCE 0.64 Mt LCE measured, 3.88 Mt LCE indicated, 2.87 Mt LCE inferred

Total JORC resource

25 years (based on only 13.1% of Measured and Indicated Resource and 7.7% of Total Resource)

Life of Mine

$1.94 Billion

Net Present Value (NPV)

36.3%

Internal Rate of Return (IRR)

$643.8 million

Construction Capital costs

$6,727/t LiOH.H2O (without credits) $5,567/t LiOH.H2O (with credits)

Operating costs

$17,000/t battery grade LiOH.H2O

Lithium hydroxide price assumption

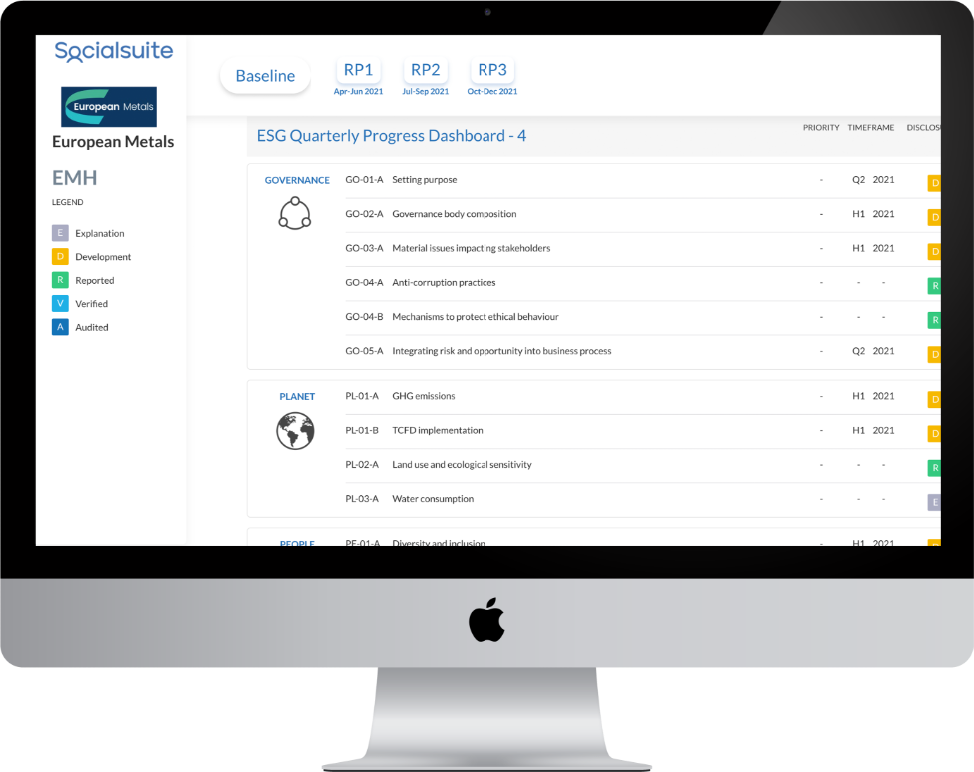

The Company’s ESG baseline dashboard report is available for public viewing.